does texas have an inheritance tax in 2020

Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if it earns any income for. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Estate Tax Category Archives Houston Estate Planning And Elder Law Attorney Blog Published By Houston Texas Estate Planning And Elder Lawyers Mcculloch Miller Pllc

This is because the amount is.

. How much is inheritance tax in Texas. The estate tax is different from the inheritance tax which is taken by the government after money or possessions have been passed on to the deceased persons heirs. The state of Texas is not one of these states.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. You may have to pay federal estate taxes but not state inheritance taxes. There is a 40 percent.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax. The state of Texas does not have an inheritance tax. However a Texan resident who inherits a property from a state that does have such tax will still be responsible.

The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. There is a 40 percent federal tax however on estates over. Texas is one of a handful of states that does not have an.

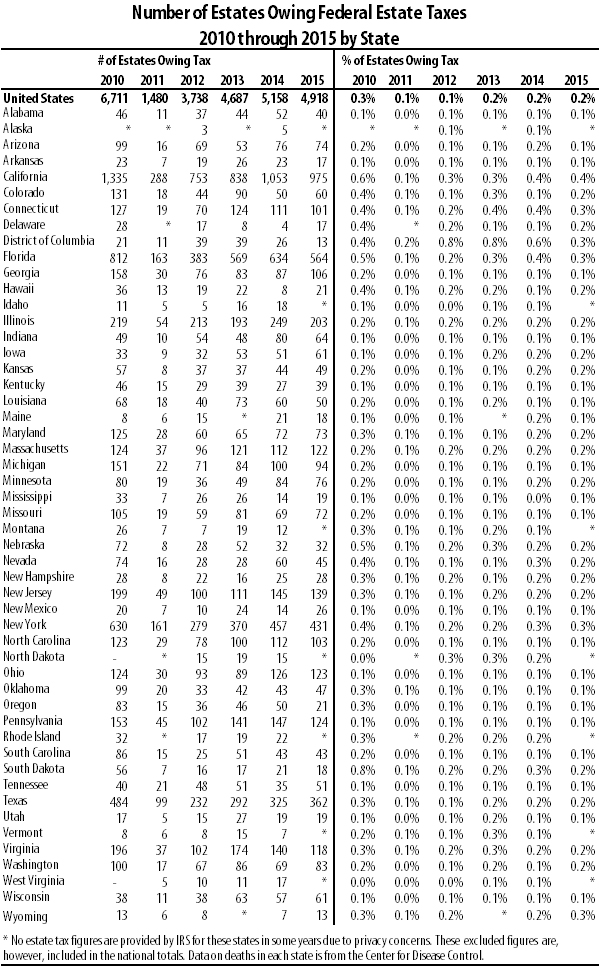

The federal government of the United States does have an estate tax. There is no inheritance tax in Texas. As of 2019 only twelve states collect an inheritance tax.

However other states inheritance taxes may apply to you if a loved one who lives in those states. Inheritance taxes are collected at the federal level and sometimes at the state level depending on the state. The tax did not.

The inheritance tax is paid by the person who inherits the assets and rates vary. An inheritance tax is a state tax placed on assets inherited from a deceased person. The tax is determined separately for each beneficiary who is.

T he short answer to the question is no. March 1 2011 by Rania Combs. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There are no inheritance or estate taxes in texas. On the one hand Texas does not have an inheritance tax. In 2011 estates are exempt from paying taxes.

There is a 40 percent federal tax however on estates over. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Inheritance Tax Here S Who Pays And In Which States Bankrate

When To Choose Munis From Outside Your Home State Charles Schwab

Texas Chapter 313 Was Killed But Still Costs Billions Through Loopholes

Severance Taxes Urban Institute

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

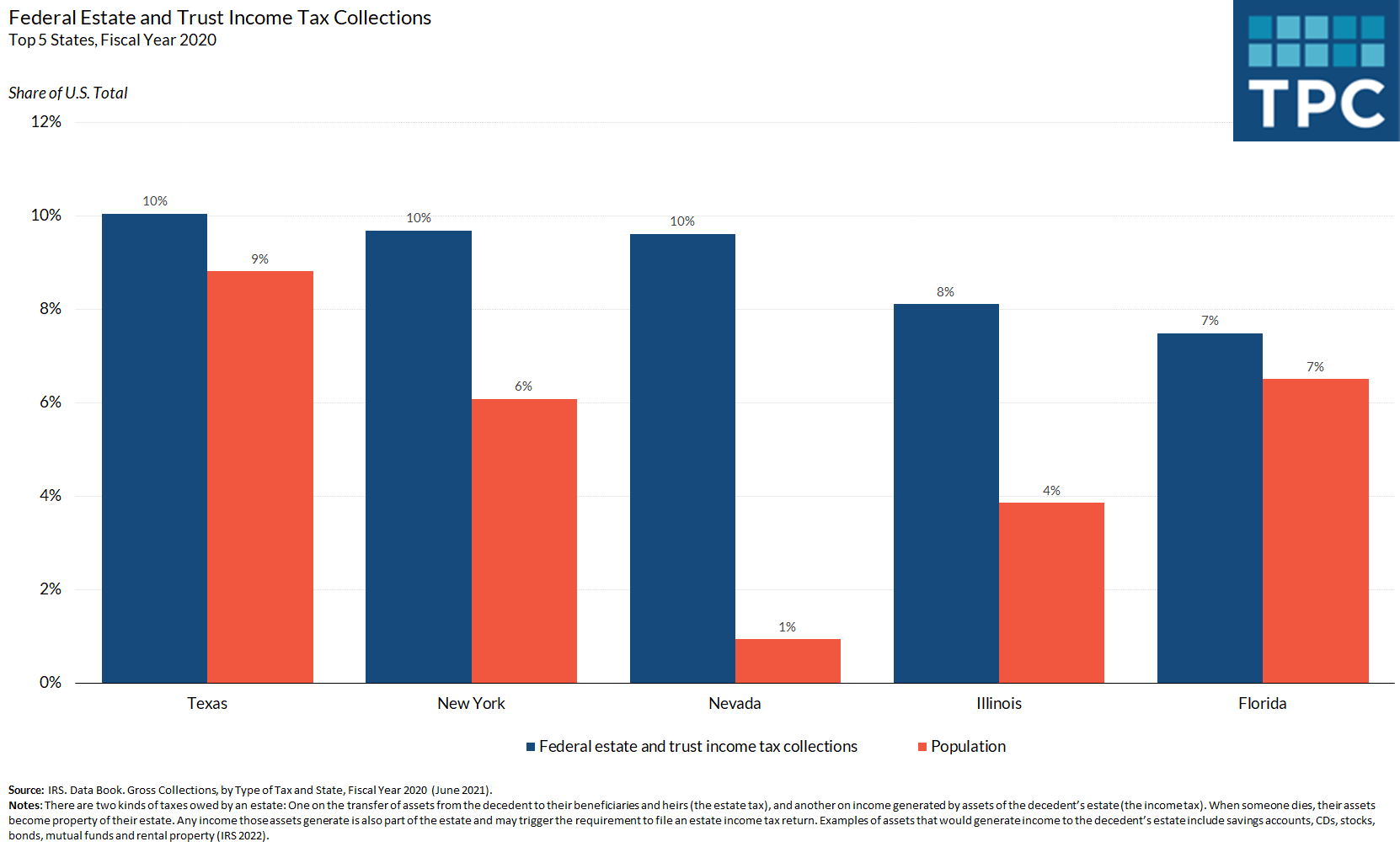

State Estate And Trust Tax Collections Tax Policy Center

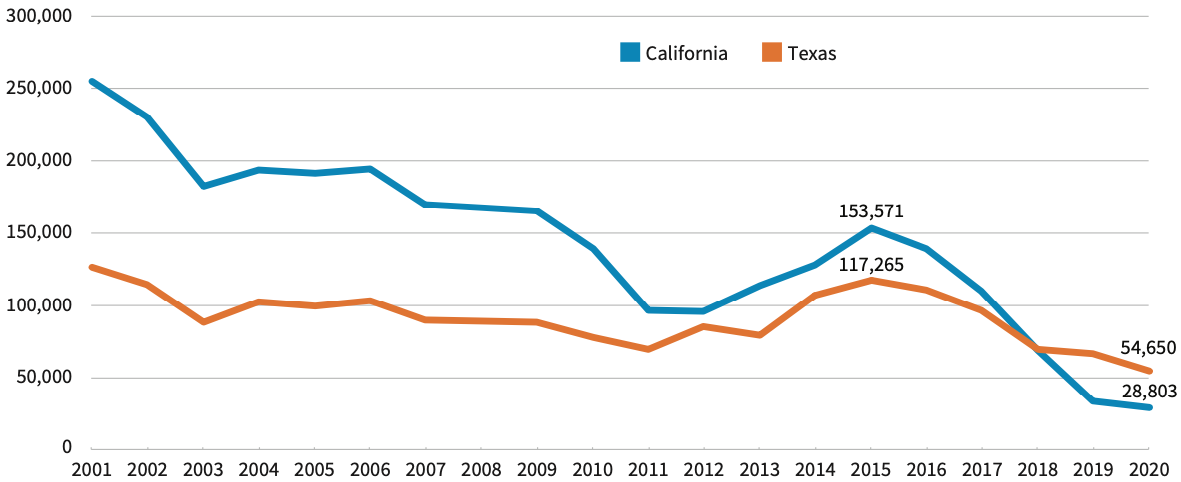

A Tale Of Two States Contrasting Economic Policy In California And Texas Stanford Institute For Economic Policy Research Siepr

Where Not To Die In 2022 The Greediest Death Tax States

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Texas Estate Tax Everything You Need To Know Massingill

9 States With No Income Tax Kiplinger

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)